What are income-producing assets? They’re investments that produce ongoing income streams, such as stocks that pay dividends, real estate you own and rent out, private business income, and so on. A large portfolio that’s heavy on income-producing assets might fund most or even all of your monthly living expenses without any need for withdrawals. Ideally, you want to take minimal withdrawals and leave your portfolio as intact as possible - so it can keep producing income for you during retirement. Add some retirement income in the Retirement (Optional) section to see how that changes the picture! Choosing a tax-advantaged withdrawal strategy If you want to start playing with actual numbers, Quicken’s retirement calculator can help you explore your options. While 67 is technically “full” retirement age, you can increase your benefits up to 24% just by waiting until you’re 70 to collect. But when you start taking benefits matters. Social Security replaces about 40% of the average person’s pre-retirement paycheck. While some retirees can thrive on $50,000 a year, others require much more. But your exact savings goal will depend on the lifestyle you want.

Typically, experts say you should expect to spend about 70-90% of what you were making before you retired. You’ll also want a bit of a cushion for medical expenses and long-term care. That depends on 2 things - how much you want to spend each month during retirement and how much you expect to bring in through a pension, Social Security, or private income streams.

Retirement planning starts by working out how much you’ll need to save by the time you retire. Figuring out how much you’ll need to save for retirement Let’s take a look at how these steps impact your financial goals. Balancing profits with financial security.Choosing a tax-advantaged withdrawal strategy.Figuring out how much you’ll need to save.

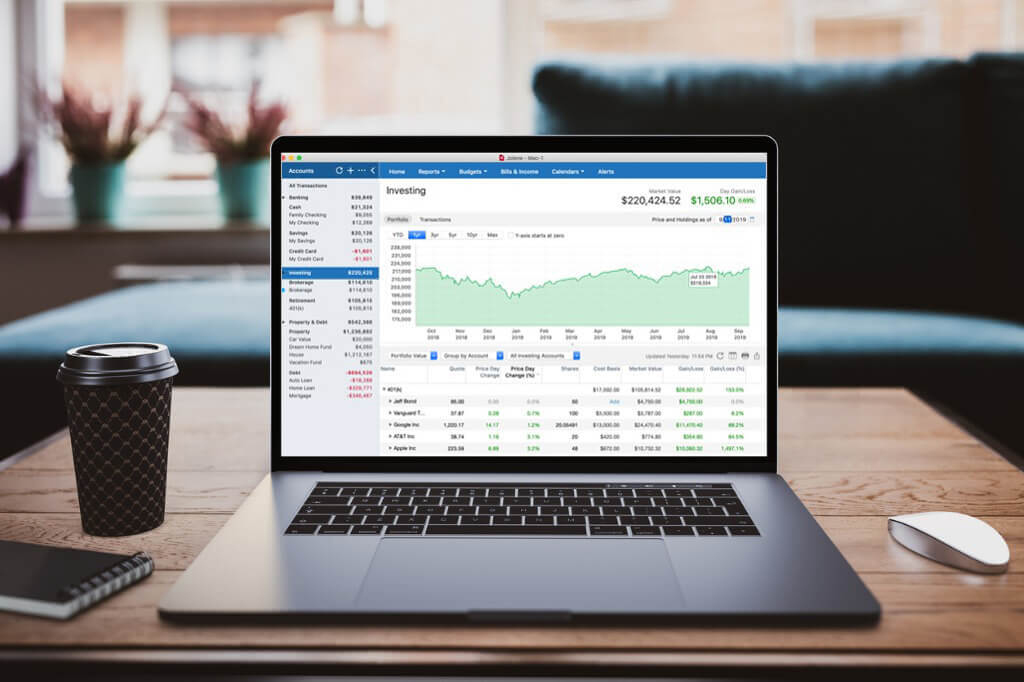

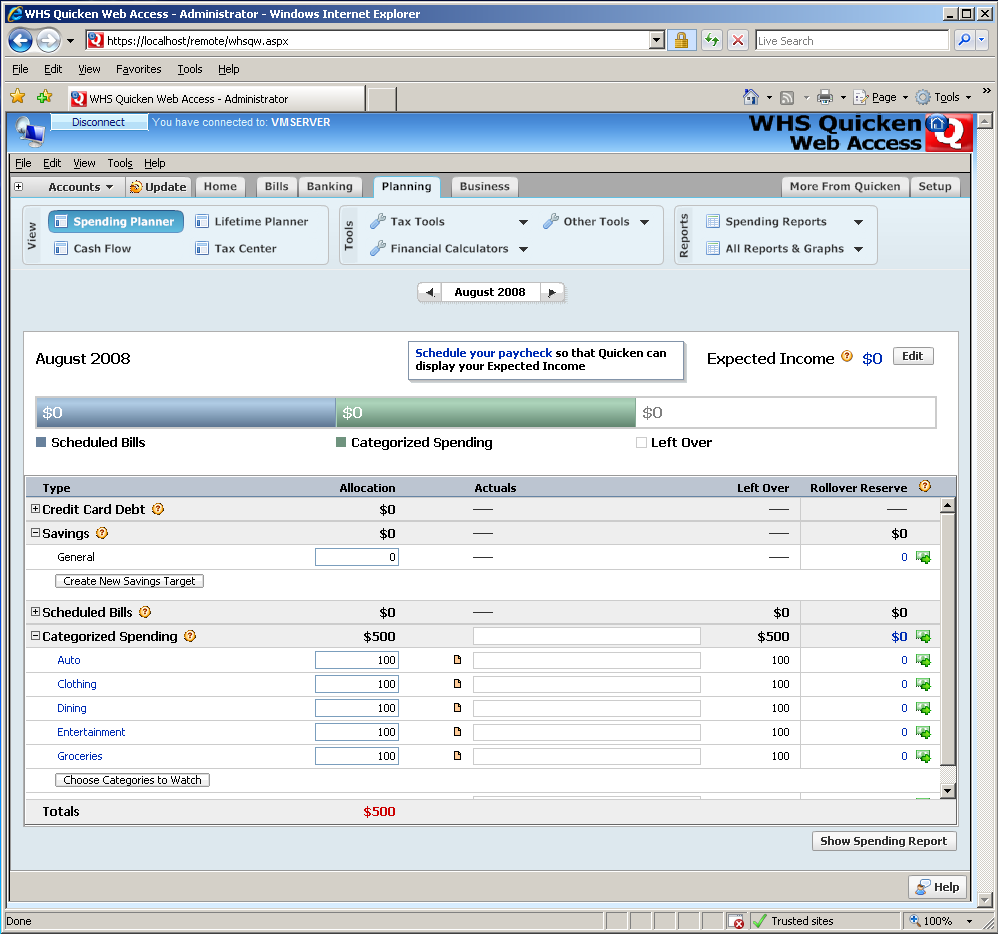

Though the journey looks a bit different for everyone, the process generally involves: That’s why successfully preparing to leave the workforce requires a comprehensive retirement investment strategy. Investing for retirement requires a long-term approach, and the budgeting, calculating, and re-budgeting never truly stop. Let’s get started! Retirement investment strategy Our suite of financial tracking and planning apps offers a variety of ways to keep tabs on your investments, loans, income streams, expenses, and much more.įor the other two, we’ll cover those right here.

0 kommentar(er)

0 kommentar(er)